Big tech's narrative in TechBio

It's role in legitimizing TechBio and unleashing the next wave of tech-first founders

TLDR - The investment of Big Tech in TechBio has not only given legitimacy to the field but will lead to more founders with tech-first backgrounds.

When people think of TechBio, the first things that come to mind are: 1) engineering first and 2) founder led. (Amee from Cantos does a fantastic summary of TechBio here) The founder-led aspect has special salience as scientific/academic founders have led the way in many first wave companies - from 10x Genomics to Ginkgo Bioworks (Alex Schubert of SciFounders chronicles these and more in a recent blog post).

Something I’ve seen less written about is the importance of Big Tech tech branching into bio+health and how this has helped embolden the narrative of TechBio itself. The gravity of the most successful and ubiquitous companies on earth applying their elite engineers to bio+health problems and hefty budgets should not be overlooked. (Alphabet seems to have invested over $11bn into bio+health which is more than the collective amount raised by TechBio paragons, Twist Bio, Ginkgo Bioworks, 10x Genomics, and Recursion.)

Although most of the TechBio companies have been started by academic founders (Jason Kelly, Daphne Koller, Chris Gibson), I think MAMAA’s (Meta, Amazon, Microsoft, Alphabet, Apple which I use here instead of FAANG) concerted investment in bio+health will lead to a much more diverse pool of founders. I’ve already seen this to a small degree with early-stage companies but with other tailwinds such as South Park Commons, there’s so much more to come. (South Park Commons activates technologists to start new companies - with 17 founded in bio+health).

There are three catalysts here, one being that most TechBio companies are founded around a combination of algorithms and wetlab experiments. However, as Amee points out, the engineering-first angle gives credence and more weight to people with a more traditional data analytics background. It’s no secret that people in big tech earn significantly more than people in academia which gives them more financial freedom to leave their day job and ‘start something new’. Lastly, the culture of continuous innovation, big impact, and the translatability of ML to many fields means people from tech companies have not only the skillset, the means, but also the culture of creation which will lead to them starting more companies.

Seemingly every week I read about a new life science business unit of MAMAA. I believe their intense interest and involvement in bio+health has helped the legitimacy of the TechBio narrative while training people at the intersection of tech and bio+health. It’s intuitive that people working at big tech companies would want to work in bio+health since it’s the basis of our life, environment and future. It also makes sense that the companies themselves are investing in bio+health since market saturation of MAMAA has led them to look for other asymmetric areas for investment and value capture. However, there’s nuance in the exact reason that MAMAA is branching into biology.

Microsoft as an enterprise behemoth and a cloud compute giant are incentivized to get as much data on their cloud as possible. Having bespoke genomic analysis tech helps with enticing more bio+health centric customers. Specifically Microsoft Cloud allows for high performance computing for R&D with special functionality for R&D execution and enhancing patient/provider experience. Along with healthcare itself, Microsoft taps into high-compute R&D with its genomics workflow allowing for simple bioinformatic analyses. It’s only a matter of time until they come out with either partnerships with the bioinformatic workflow companies (such as Latch, Watershed, Form) or fully commit to the bioinformatic workflow industry by expanding the scope of its offering.

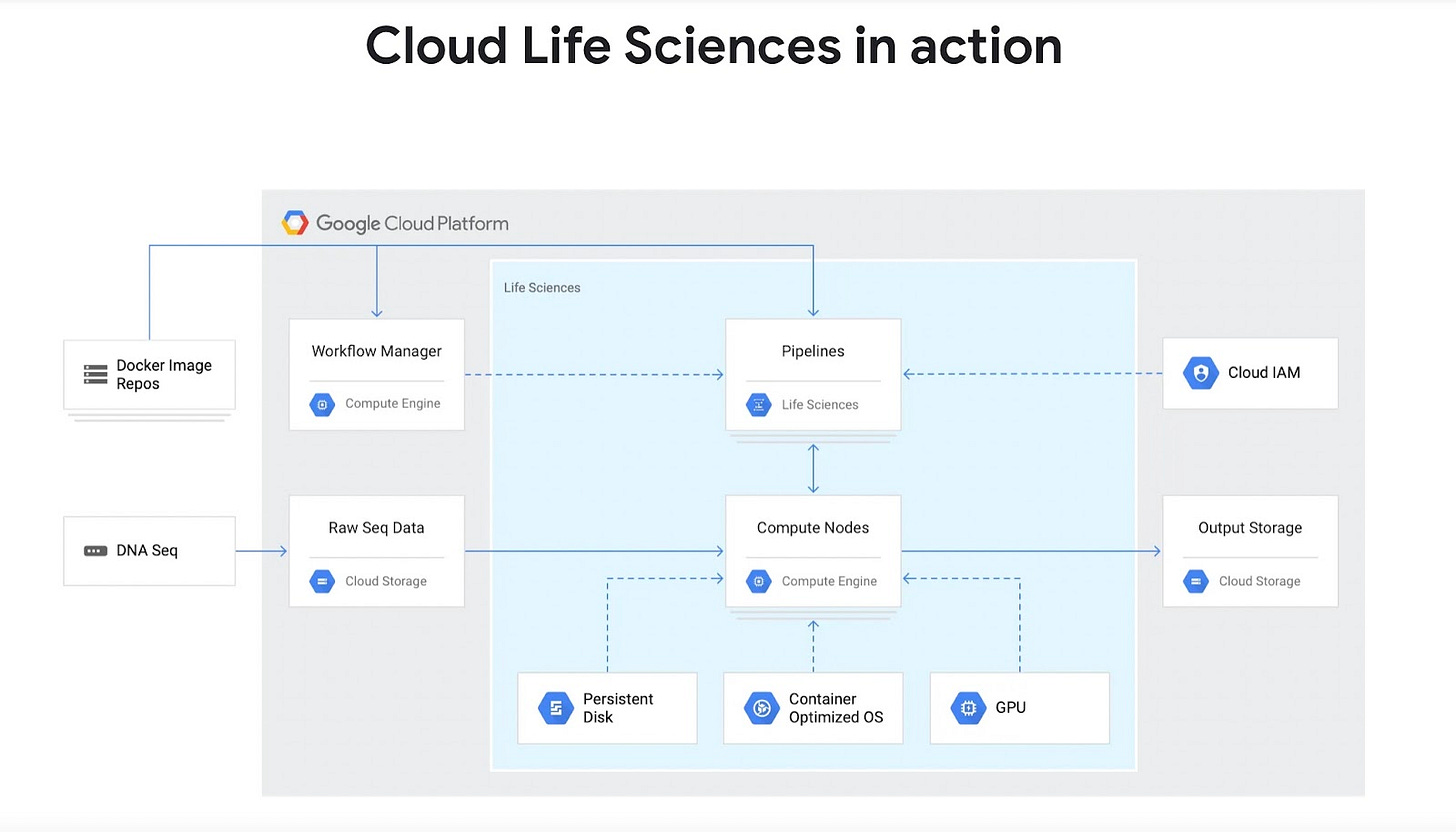

Alphabet search is under fire for the first time in years but has been investing in other asymmetric areas to prepare for this day. In order to supplement search, they have made only high-risk investments since only these have the potential to supplement the income from search. This has paid off to some degree where, in their 10k they claim to have $600-700 M in revenue from ‘Other Bets’ which seems to be mostly from the health technology space. They have struggled in getting many of these initiatives to scale and we’ve seen many projects axed. Despite the difficulty, they’ve continued to invest in many different bio+health verticals from the life sciences research org, Verily, to Deepmind which is pioneering protein structures, and more recently establishing a wet lab at Francis Crick (with an eye watering investment of $2B). Moreover, Isomorphic labs works on an AI-first approach to drug discovery and, like Azure, Cloud Life sciences tries to bring more people onto its cloud via special life science functionality. Beyond this there’s a dizzying array of other investments, which collectively seems like desperation to grab a foothold in bio. Without one of these becoming a multi-billion dollar generating company, Alphabet continues to walk the tightrope of investing in more areas and looking for acquisitions.

Calico - working to combat aging with $2.5bn + funding from Google and Abbvie

Google Health - increasing patients health information, focusing on connected care

Mineral - facilitate sustainable and data-centric agriculture

$2.1 bn acquisition of Fitbit in 2021

GV - $8bn AUM, a lot of which is dedicated to bio+health

For Meta, it’s only recently become clear why they’re interested in proteins with the launch of VR protein structure visualization, Nanome (albeit not a Meta company). Through this platform you can see the tremendous advantage they could have in the scientific collaboration space, as the means of collaboration and through providing (potentially exclusively) the protein structures. Nanome, though a separate company, is available with the Meta Quest Pro. In addition to ESM, Meta is also working on catalyst prediction with Fundamental AI Research (FAIR) and Carnegie Mellon University's (CMU). This project is to ‘fund new catalysts for use in renewable energy storage to help in addressing climate change’. The results of this could hypothetically be engaged with through the Metaverse but seem to have a more philanthropic slant.

Amazon has always been searching for pillars outside of cloud, e-commerce and healthcare is an extension of their ‘everything store’ vision. This is evidenced by Amazon’s acquisition of One Medical as well as the Amazon Clinic. Amazon is also in the pharmacy space with Amazon Pillpack although that has been reportedly struggling. Besides their $200M science-focused fund, specialized bio workflows for cloud helps bring more companies to their cloud. Like Azure, Amazon Omics allows for specialized workflows. In the words of Mike Dempsey, ‘Amazon has atoms and everyone else is bits’.

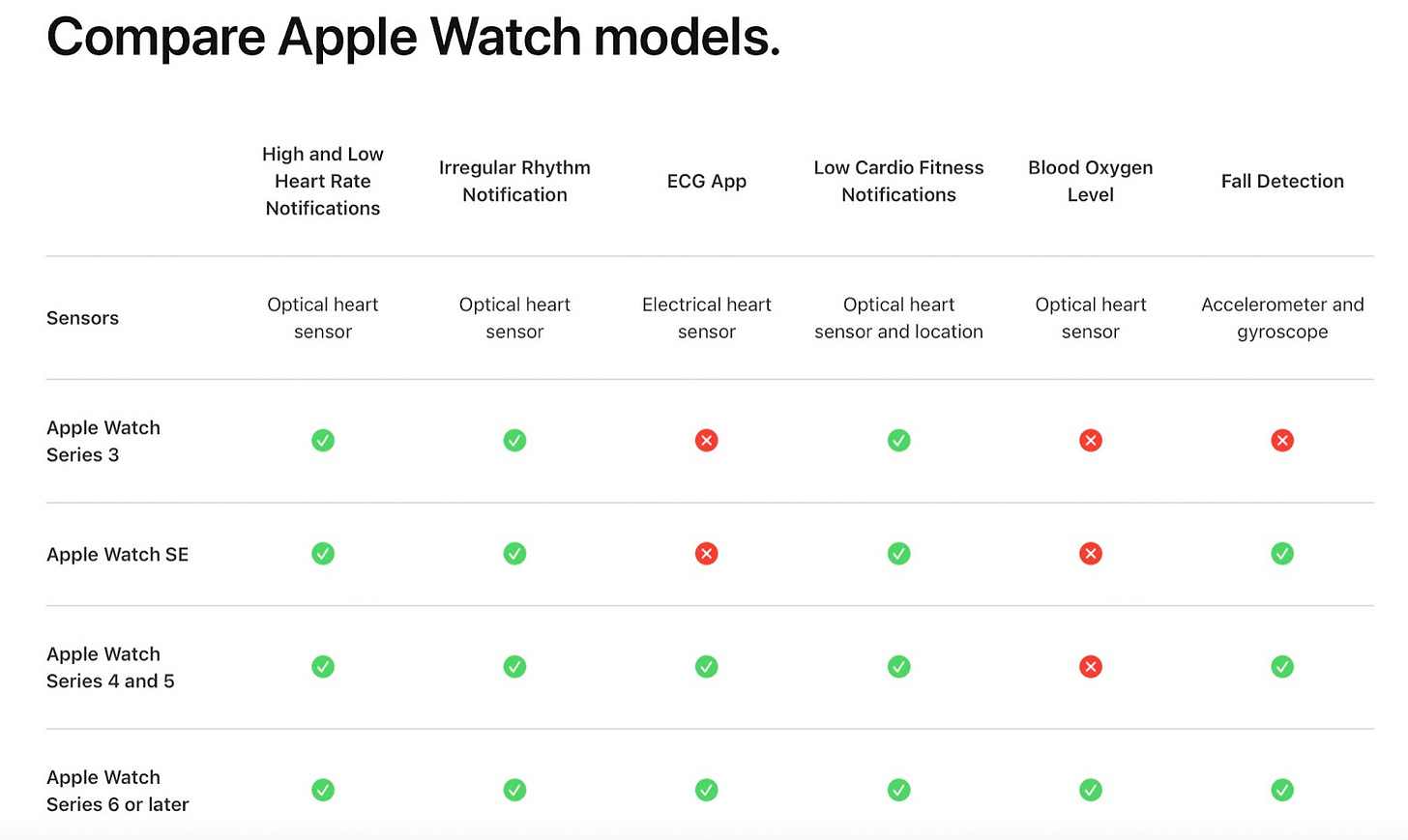

Apple is more in the Health IT space and has been a dominant player there since 2012. Apple, as a hardware provider, thinks that the next reason we are using their products is to monitor health. Apple Health consolidates your personal health information from their health app and Apple Watches which are increasingly sophisticated. Currently functionality expands from heart monitoring, fitness notifications, blood oxygen levels, ECG, and fall detection. Apple is making motions in the care space as it has suggestions for Clinical, Nursing, Patient Experience, Care at Home, and Medical Research. In this context, Apple and Amazon are the most direct competitors, both trying to take the care market.

Collectively, MAMAA has unleashed some of the best engineers on earth to bio+health problems. This glut of talent and massive investment by some of the most respected companies on earth gave TechBio more legitimacy and talent to potentially reach goals we didn’t think possible. MAMAA has even collaborated by working on Terra (Microsoft, Verily, Broad) to facilitate collaborative biomedical research by building an open platform that connects researchers to each other and to the datasets and tools they need to achieve scientific breakthroughs. Moreover the most successful tech entrepreneurs (Bezos, Musk, and Gates) have all invested in brain-computer interface companies adding legitimacy to more blue-sky areas in bio+health.

Market saturation of MAMAA has led them to look for other asymmetric areas for investment and value capture. The relative upstart, Stability AI, are both breaking ground in bio with projects in DNA generation from text prompts and better protein folding predictions. I’m excited that big tech’s investment in bio has converged with scientist-founders taking companies public, creating massive returns. I believe we’re at an inflection point where more founders with tech backgrounds will defect from big tech and start their own companies. Specifically, their financial security, culture of creation, and skillset make them very well-suited to start the next generation of TechBio companies. I’m excited for the momentum of the industry and think we have a lot to thank big tech for, in its help in underwriting this new field.

If you’re at a big tech company, MAMAA or not, feel free to reach out at any time. I’m at shelby[at]compound.vc.

A huge thanks to Mike Dempsey that helped in the framing and expansion of this blog post!