Product vs. platform in synthetic biology

New data fly wheels, the importance of chassis selection, and enabling business models

TL;DR

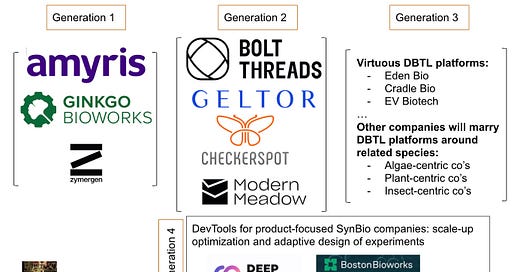

In 10 years, there will be the equivalent of 20 Ginkgo Bioworks. The figure below is a mind map of where we are in synthetic biology - Generation 1&2 - and where we are going - Generation 3&4. In short, synthetic biology has shifted from platform (Generation 1) to product offerings (Generation 2) and is headed back to platforms (Generation 3&4). The nature of the new start-ups in Generation 3 will be much more clustered around related chassis design, build, test, learn (DBTL) principles from the onset. Generation 4 synthetic biology companies have required a critical mass of start-ups in order to be financially viable and are premised on their ability to optimize experimental and fermentation scale-up processes and that not many companies will have these capabilities in-house. This piece explains the state of Generation 1 & 2 and why the both Generation 3 & 4 companies are good investments in the future.

Context

Earlier this year, I published a list of synthetic biology companies, most of which use precision fermentation to create consumer and industrial products (cement, soaps, gelatin, coffee). Many of these companies and their precedents (see the figure above: Generation 1&2) are predicated on the increased importance of biomanufacturing replacing incumbent petroleum products. After all, biomanufacturing is better for carbon footprint reduction, arable land use, and even national resilience. There are far reaching consequences for making the manufacture of goods purely a domestic exercise. Azeem Azhar in The Exponential Age sees the rise of synthetic biology manufacturing of commodities as a reason for rapid deglobalization in the next century. Although this brings the potential for massive geopolitical shifts, it requires a similarly revolutionary optimization in the way commodity synthetic biology companies achieve cost-parity, and eventual superiority, to incumbent petroleum-based products. In Ginkgo’s most recent 10-K, they estimate trillions of direct annual impact from biomanufacturing by 2030.

State of the industry

The legacy biomanufacturing companies like Ginkgo/Zymergen and Amyris haven’t performed well for a variety of reasons including broader macro sell-offs, multiple compression, poor business models, and more. However, technically the companies have improved time-to-market and unit economics for scaling-up programs. For example, Amyris has shortened the time in translating lab results to products from 3-4 years to less than 1 year, according to their most recent 10-K. They attribute this to “leverag[ing the] technology platform with proprietary strain construction, screening and analytics tools, advanced lab automation, and data integration.” Currently Amyris has 13 products in the market.

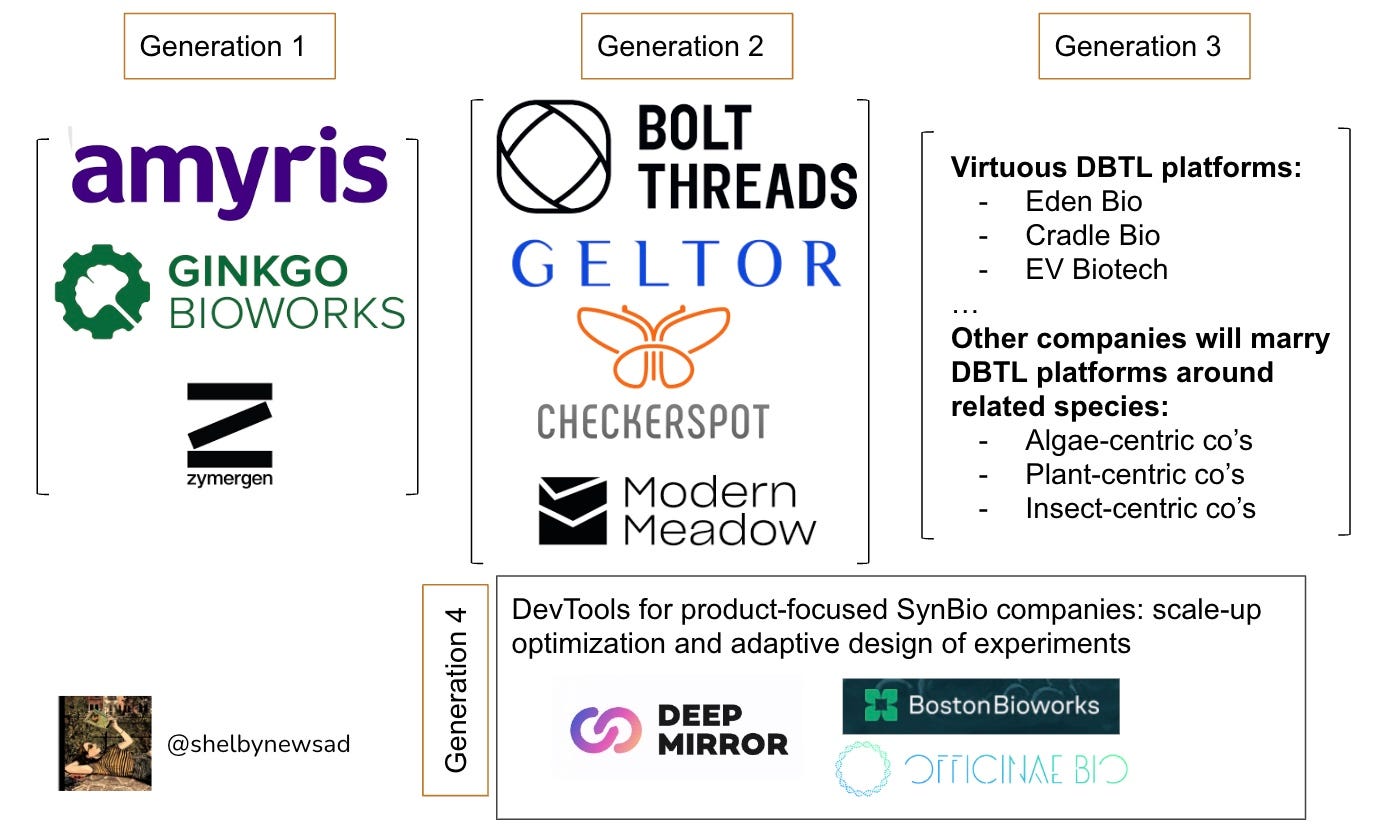

Ginkgo’s 10-K attributes its current and future success of its 105+ programs to the dual Foundry and Codebase. I knew Ginkgo was likely collating its data and automating many of the processes but I hadn’t understood the economies of scale their platform is able to achieve. Namely, the 50% decrease in unit operations and 3X foundry output which Ginkgo explains in their 10-K:

“Our Foundry wraps proprietary software and automation around core cell engineering workflows—designing DNA, writing DNA, inserting that DNA into cells, testing to measure cell performance—and leverages data analytics and data science to inform each iteration of design. The software, automation and data analysis pipelines we leverage in the Foundry drive a strong scale economic: we have scaled the output of the Foundry by roughly 3X annually since we started measuring it around 2015 [...] and over that time, the average cost per unit operation has fallen by approximately 50% every year. […] Our Codebase includes both our physical (engineered cells and genetic parts) and digital (genetic sequences and performance data) biological assets, and accumulates as we execute more cell programs on the platform. Every program, whether successful or not, generates valuable Codebase and helps inform future experimental designs and provides reusable genetic parts, making our cell program designs more efficient.”

Pre-IPO companies like Bolt Threads, Checkerspot, Modern Meadows, and Geltor go after narrower ranges of products and don’t speak as much about platform/expansion capabilities, making them fundamentally distinct from Ginkgo and Amyris. Bolt Threads makes synthetic spider silk and mycelium-based leather for fashion and sports brands. Geltor is an Ingredients as a Service (IaaS company) that specifically produces elastin and collagen (patents here). Modern Meadows makes two biomaterials (Bio-Tex and Bio-Alloy) and collagen. Checkerspot uses algal-derived oil to make WNDR Alpine products such as skis, snowboards, and apparel. As highlighted in Tsung Xu’s recent post, Checkerspot’s vertical integration is particularly unique as it sells its algal derived products directly to consumers, and did this in a remarkably short amount of time. Checkerspot was able to launch 3 commercial products within 4 years of incorporating the company. Checkerspot’s success is partially attributed to the founders (Charles Dimmler and Scott Franklin) that benefited from their prior work on D2C algal oils at Solazyme. These companies that have collectively raised over $820M demonstrate that a small set of niche products done well can create enough traction to merit continued funding. However, it’s still to be determined what types of exits will be realized for these companies, what their revenue looks like, how they’re improving their economies of scale and the exact nature of their platforms. Without being able to look under the hood, it’s impossible to understand if they can be labeled as successful. That being said, from a meta level perspective these products likely felt more tangible than Generation 1 platforms and were easy to understand for VCs. This matters because they were started and grew when ‘techbio’ was still new and many VCs were doing their first bio investments. As the industry evolves and these investors learn, it’s likely that the type of companies they’re investing in will evolve from Generation 2 to Generation 3 & 4.

But what does this mean for the state of the industry today?

Ginkgo’s ever-expanding and optimizing platform will be an existential threat (as Google/Amazon are for many tech companies). Therefore, emerging companies will need to continually optimize their processes which could be accomplished by building their data engine flywheel or by partnering with a service/platform company that’s able to model protein, culture, and potentially metabolic optimizations. Platform analytics companies that help with analytics, scale-up and design of experiments include Officinae, Deepmirror, Boston Bioworks and Invert Bio. I predict there will be more companies in this arena with differentiating criteria being their ability to take the company from a service to a platform, long-term customer retention or life-time value of customer, and capturing enough of the data to reach the virtuous cycle across many different organisms. A competing future is one where companies build automation and modeling platforms in-house and integrate that into their product production (essentially Ginkgo 2.0). But because they’re not retrospectively trying to understand the data, they’re able to better capitalize on the learnings and directly compete in a platform → product fashion. Additionally, I predict that they will be very focused on a very small number of chassis to make sure their DBTL learnings are interoperable. There are a few companies working towards this future (Cradle Bio, Eden Bio, Phycoworks and EV Biotech) and certainly many more will come.

Tying it all together

My gut feeling is that there’s room for many companies to play in purely product, platform, and enabling areas given the trillion dollar market size. To put this in perspective it’s the equivalent of 10-20 Ginkgo’s. If we continue along the Ginkgo trajectory, that's 1,000-2,000 programs in full swing by 2030. As time goes on, product centric companies without their own or outsourced data platforms will become more difficult to fund but key partnerships with synbio DevTools will become an essential commodity. Data capture and accelerated learnings that are possible with the Generation 3 & 4 companies will create tremendous value while catapulting an entire industry. However, not all biological systems are created equal and the data learnings from Pichia pastoris may not be relevant for Bacillus subtilis or Synechocystis sp. Thus important value levers will be around picking the optimal suite of chassis where the data collected now will allow for optimized suites of products tomorrow.

Because of this, I envisage the greatest successes coming from companies and platforms built around related chassis (fungi or algae or bacteria) so they are able to capitalize on learnings and share genetic parts. With this lens, I believe a company like Phycoworks, which is using ML models to optimize product production in algae is ahead of its time. Unlike the tech industry, and as highlighted in Dennis Gong’s Anti-TechBio, biology is context dependent. Companies that work with the context dependence of biological systems will be able to build interoperable learnings and parts creating tremendous moats around their products. The next piece of the puzzle is elucidating the most versatile, fast-growing, and nimble suite of chassis on which to build.

I’m interested in learning/ideating more about these types of companies that are creating data fly-wheels in the scale-up process. If you have ideas or new models here - please reach out.

Thanks to Mike Dempsey for his help refining this article.

Hi thanks for this article. What I generally miss in these kind of articles that a Synbio company and a Product company are very different. And combining them in one company may not be the best use of capital. There is a reason why Apple does not assemble a phone or makes steel. This strategic insight should be highlighted as well in the thinking about Synbio.

is it fair to take from this article the author is bullish long-term on Ginkgo Bioworks?

(not financial advice ofc)