A little over a year ago, I wrote about how platform biotech is going through a recalibration phase. This recalibration phase is primarily based on increasing predictive validity over the number/size of the screens, increasing chemical space, and directly focusing on value attribution which can be shown at the level of clinical trials. Since the original post I've seen many manifestations of narratives, business models, and proof-of-concept data which have led me to expand my thesis on the space. I want to share my observations on how the market has changed and what companies need to have to raise funding in this non-zero interest-rate policy (ZIRP) environment.

There have been an increasing number of platform companies that have more fully verticalized into building assets across diseases or chemicals. Examples of new tech include new model architectures (transformers, Mamba, Hyena, RWKV) applied to biological data or new screening or measurement modes (Eikon’s single-molecule tracking platform, Enveda’s mass spectrometry deconvolution platform to understand new chemical space, or the ATLAS platform of Kimia therapeutics which automates synthesis and screening of new chemical space or even Solugen’s cell-free synthesis platform).

This has been a drastic shift from the ZIRP environment where resource allocation outside of the platform itself wasn’t valued by the market as it was perceived to cap the upside of a company by allocating resources to products, until much later (Recursion had 4 early clinical assets when it IPO’d 8 years after company founding, Exscientia currently has 2 clinical assets, Relay Therapeutics has 3). The focus on value attribution in the clinical trial stage assets has only increased in the past 12 months because you have a risk-adjusted shot at assets (many shots on goal) and need at least one to work. The proof is in the pudding and needs to be shown as quickly as possible in order to attract large pharma partnership deals. Because of this need of validation, I’ve seen more focus on rare disease groups to get fast validation or seed funding going towards higher order validation in non-human primates.

It’s easy to scoff at the ZIRP environment, shake our heads at the naivety of the investors, entrepreneurs, and operators, but hindsight is 2020 (both in vision and actual dates).

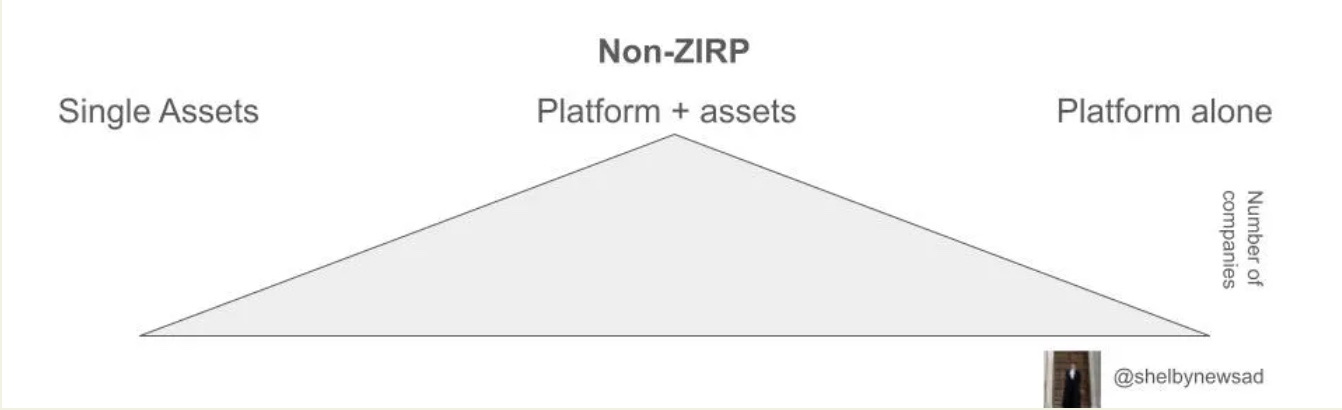

What’s clear is that there’s been a collective increase in sophistication of investors and entrepreneurs for understanding the technical and product proof points required to show your platform works (1) and thus can unlock later stages of capital (2) and eventually make hundreds of millions of dollars (3). Put simply, every company needs to be built to withstand different funding and hype cycles and thus needs dual platform and asset approach.

I’m seeing the majority of ‘platform’ companies making assets themselves and getting these to a large of a scale or close to the clinic as their runway will allow. For those companies who raised in ZIRP on the pretense of building the ‘best’ platform, they’ve by and large struggled with many going out of business. In cases where they have managed to raise later capital the amount of funding they’ve raised sometimes puts them in a place where they need to jump through the hoops of what is now the last round of funding and those required for the following round, a difficult burden.

However, for companies starting in recent history, there’s an understanding that they need to:

Focus on platform differentiation and show with your products (target and assets) why what you’re building is different from anything in the market

Always create a data package sooner rather than later and show from both in vitro, cell, and animal models that your asset is exceptional in its own right and compared to standard-of-care and clinical assets

Choose indications which allow early PoC validation that your platform works + bonus points if there’s a MoA with an indication with a larger disease population

Another PoC is partnering on the platform and on the assets. This doesn’t have to be on the first round of funding (assets matter more here)

This list is inherently more therapeutics focused but a similar list could be made for synthetic biology platforms.

Focus on platform differentiation that your chassis can unlock new chemicals or post-translational modifications. (Checkerspot has done this incredibly well by making skis from algae oil which have less friction than petroleum-based oil.)

Show the titer increase and marry this to a high-margin, high-need use-case

Demonstrate that there’s eager market uptake for this innovation through partnerships

With this data and validation in hand, companies being built today for non-ZIRP have the ability to outstrip their ZIRP predecessors, access more capital, and potentially achieve market dominance. I’m not as naive to say that the best companies are always built in market downturns, but in this specific environment where we have platform tech than will increase company upside and earlier routes to validation, I’m bullish on the vintage that is 2023-2025 (and hopefully beyond).

Although goalposts will change again I feel like the battle scars from the ZIRP to non-ZIRP environment will stick with us and help us collectively make the biotech ecosystem more capital efficient and impactful.