A general sentiment we hold at Compound is that we’re more ideas constrained than tech constrained at the moment. This has manifested in bio with an inevitability that any new tech or platform will be applied to therapeutics at some points in a company’s life cycle. You see this with Ginkgo expanding to pharma clientele and Zymergen pivoting to therapeutics mere months before it was bought.

However, to assume this will always be the case is myopic at best. Biologizing the stack is one view of this but, to take a customer-centric approach, let’s look at the consumer which has rapidly evolved in the past 20 years.

If you asked someone in the early 2000’s if they were healthy, their heuristic for this would have been if they exercised 3x per week and ate a ‘healthy’ diet. 10 years ago, these people wore Fitbits, today they wear Oura rings.

We’ve also seen an increased focus on broader trends surrounding wearables and quantified health, best exhibited by the growth of non-diabetes patients wearing continuous glucose monitors (10s of thousands) or a wave of people (30M+) participating in D2C biological tests (10’s of thousands for the CGM and 30+ M for D2C biological tests).

As you go further out on the advancement and perhaps curiosity curve, we see millions of people taking peptides off-label (most notably exhibited through the 56% of people take Mounjaro and Ozempic that do not have a diabetes diagnosis). And of course, at the forefront of this is the (now trite) example of people like Bryan Johnson who spend $2M per annum on health.

While product sales are a lagging indicator, a leading indicator to understand this coming wave deeper can be seen in the growth and chatter amongst communities both online and offline. Huberman lab has >3.5M subscribers, Outlive by Attia has sold over 1M copies, 200k people are on r/Biohackers and r/peptides subreddits. In comparison to the population, this is a small number but one we expect to meaningfully grow both vertically and horizontally over the coming years.

Despite this consumer evolution, the product evolution has lagged, with an over-concentration of me-too nutritional products. Although they fit different user needs (Kind bars for snacks, Soylent for meal replacement, AG1 for vitamins), these products don’t show the rigor and sophistication that consumers have shown and that we believe will become table stakes for consumers in the future

These table-stakes products have different characteristics than the prior generation. They are based on peer-reviewed research and are borne out of novel ingredients and approaches. We call these science-driven consumer products.

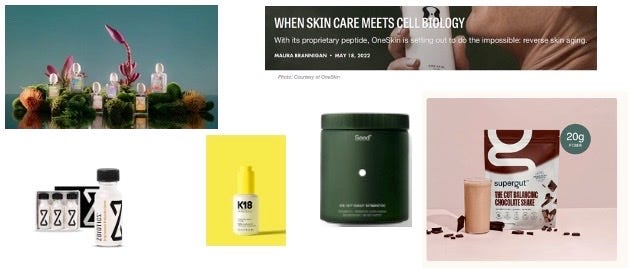

There are a variety of companies today which prove as interesting early examples of both product innovation as well as category selection.

Oneskin is one example which has developed a peptide that kills aged (senescent) cells. Adjacent to this in the aesthetic care space is K18 hair, which came from research in a lab which mapped the keratin structure of hair and then formulated a peptide to bring the keratin hair back together.

Other notable companies in other ares of focus include Seed (hub-and-spoke model for consumer formulations of bacteria), Supergut (starch fiber which regulates blood sugar), Zbiotics (GM bacteria which stops you from being hungover), and Future Society (fragrances resurrected from extinct plants).

The science-driven innovation (while also having a meticulous approach to branding) of these companies yields better moats and higher pricing power (because the products work and/or are differentiated by ingredients). Compared to traditional bio businesses, these companies have faster iteration times (don’t need 5+ years for clinical trials), lower CapEx, and increased customer retention.

There are also attractive regulatory moats through the Generally Regarded as Safe (GRAS) and New Dietary Ingredient (NDI) pathways.

Ultimately the sophistication of products will catch up with consumers and move the Overton window of scientific sophistication in consumer products. The tailwinds of consumer uptake are bolstered by the fact that many feel the traditional healthcare system has failed them so are taking their health into their own hands. More sophisticated services were the first part of the market to address people wanting to take health into their own hands. Functionally this has worked because we can use the same tests used in traditional clinics for ‘sick’ care for ‘health’ care. Looking at nutrient panels, inflammation, pre-emptively scanning the body for tumours, etc. Companies using these services are Ezra, Prenuvo, Forward Health, Fountain Life, to name a few.

The lag in product (instead of service) development, in part, due to the time it takes for scientific discovery but also due to the diverse confluence of actors it takes to bring products to market (sales, operation, brand, and product talent required). Thus, companies built here have a double edge in talent and science which makes new entrants more defensible.

These dynamics and many others that we’ve worked through via internal research and conversations make us feel very strongly about the compounding nature and efficient value capture that can and will come from science-based consumer products. We have deeper thoughts for what this means for margins and defensibility but are reserving these deeper thoughts for conversations with those deeply engaged in the space. Together, there are compounding network effects which can create a lot of value in a comparatively small amount of time.

There will soon be many more examples of companies here. Please reach out if you’re building here. I’m at shelby [at] compound.vc.

Thanks to Mike Dempsey for your edits on this piece!

As usual, love the articles here! I agree on the science-driven CPG. There are lots of wellness products out there with little science or efficacy behind them.

Nice shoutout to Zbiotics. Zach has done some good work there. I would add to that list: Persephone Biosciences. Female founder/CEO with science-drive approach to probiotics focused on infant health initially with applications to menopause and cancer down the road.