Unlike general AI, bio has additional atom-level complexity for experimentation, scale, and entrenched incumbents which you need to get on board for short-term cash flow and vicarious brand validation. Although we do see emerging areas such as biohacking and DeSci as less wed to previous brand and partnership standards, the majority of the net new companies started in bio are working in the incumbent drug discovery industry.

In Mike’s piece on the Shifting Dynamics & Meta-moats of AI, he points out:

‘Once a startup is able to create enough early moats, they then move into the necessity to continue to maintain velocity over multiple years. Again, capital will continue to flow into the space creating competition across multiple vectors for your business for longer than many appreciate, and as model performance commoditizes, incumbents will also begin to be late movers in some areas.’

Speed required for most bio companies is speed to clinical validation rather than speed against competitors.This is somewhat comparable to bio in terms of companies needing to create early moats (typically around a model, screening tech, gene editor), but what’s different is that there’s technological lock-in after a certain point. Even if you’re working in the same therapeutic area, with the same modality, two drugs can achieve significant market share (Humira and Enbrel are an example here). Moreover, similar platforms can be used for different use-cases, which if solved, are very large businesses.

The upshot of the same tech advances being applied to many different use-cases means that, at least in the intermediate term, there will be more successful therapeutics than in the past history of biotech. We’re seeing indications of this from AI-discovered drugs having 80-90% Phase I success rate as opposed to the 40-60% success rate in historic Phase I studies. There also has been somewhat of a reversal of diminishing returns of pharma productivity with a reversal of Eroom’s law reported in 2020. Despite this projected increase in successful treatments, the indication areas remain limited based on known diseases with known pathology, correct delivery capability to certain tissues, amongst other things.

In the short-term what this means is we'll continue to see more verticalized/specific approaches to certain biological indications/problem spaces due to the need to still work within the existing regulatory and industry frameworks. Though ‘vertical’, these platforms can still more accurately address several indications over the lifetime of their company and have seen this manifest through companies addressing diseases whose pathology is driven by different biology kinase dysregulation (Harmonic Discovery), intrinsically disordered proteins (Peptone), immunity (ImmunAI), hepatic disease (Ochre Bio), delivery (Dyno, Mana) and many more.

As it stands, no tech is quite good enough to do all the bio things at once. As the learnings of the short-term proliferate through the industry, the mid- to long-term transformation may mean that new companies begin to see progress towards general biological intelligence (GBI), or the short-term winners expand first-hand or via M&A into more horizontal AI-enabled therapeutics platforms. A few companies seem to be working towards the GBI premise (EvoScale, BioOptimus, and a few in stealth). What’s unclear is if model performance, scaling laws, data accessibility, and capital pools available today will actually generate general biological intelligence (GBI) on the timeline envisaged.

The ChatGPT moment for AI in bio

Imagine if AlphaFold2 was released not by a research arm of a big tech company, but by an independent, for-profit company. This is what I think the OpenAI moment in biotech will look like. To truly set off the races for the biotech industry though, I think the company needs to create a bigger technological step change. As Ruxandra points out, AlphaFold today cannot accurately predict the effect of point mutations.

https://x.com/RuxandraTeslo/status/1783582730514522402

In a way, the AlphaFold2 and OpenAI comparison holds because both started pursuing serious commercial endeavors after they released their respective models. With AlphaFold2, Isomorphic Labs was born and OpenAI started to gate the model with a subscription fee (though now there are open source versions available). (Side note that it’ll be interesting to see where AlphaFold3 sits in the Deepmind/Isomorphic ecosystem.)

There is a key difference between the two - OpenAI was immediately actionable in people’s everyday life, helping speed up their email drafting, essay writing, and paper summaries whereas AlphaFold2 wasn’t immediately actionable. By this I mean that it, in most cases, hasn’t sped up or made drug discovery better, faster, cheaper. Despite this, it’s only a matter of time before models are able to predict function. An open question to the field is what types of companies will be created when, to quote Mike, biology moves from “x but with AI” instead to building a novel thing that is “y because of AI.”

In the case of a true step change, I think that an accurate prediction of protein dynamics will be biotech’s true ChatGPT moment.

Taking a step back, companies need to ask themselves whether they’re building on the application layer (applying advances to a specific use-case) or if they’re building on a foundational layer (OpenAI for biology). The ‘application’ layer is a bit too simplistic as there’s normally some element of novelty on the model architecture side but the premise is that the model is a means to the product (a new therapeutic). There’s a well-known playbook for bio companies on the application layer but those building on the foundational layer, will need to innovate at each stage of the business, create idea moats around their technology, educate the investor base on milestones, and likely need to be producing useful tools for incumbents and/or scientists along the way. Most companies on the foundational layer won’t have limitless pools of capital like OpenAI did so will need to be excellent at (potentially) creating intermediate milestones in the form as well as technology.

Depending on the application vs. foundational layer companies will have different infrastructure requirements (around compute, data, talent), with the foundational layer having much higher capital requirements for them all.

Despite my interest in both the foundational and application layer of biology, this piece focuses more on the application layer. Those interested in the foundational layer will find Mike’s post valuable.

Why bio is different

A core part of our annual letter is that bio is *not* recursive like AI is. Simply put, just because we can cure many leukemias and forms of breast cancer does not mean we can cure pancreatic cancer. The upshot of this is that bio is inherently more incremental than AI is. While this seems like a downside, in actuality, there is room for *many* large businesses in drug discovery businesses because any given company needs only 1-2 drugs to work (in a large enough disease area) for a really big business to be built.

Then why doesn’t everyone invest in drug discovery?

I’ve been back and forth with this point for many years, struggling personally to make new investments in therapeutic platforms which are internally developing assets. In the past decade there’s been a shift of external pools of capital (from traditional tech funds such as Kleiner Perkins, Founders Fund and funds who made their money in Web 2.0 shifting focus entirely to bio, like Artis) on the early-stage side. The collective consciousness around the importance and utility of biotechnology briefly captivated the world’s attention and imagination as immunizations and rapid drug repurposing decreased death by COVID significantly. Moreover the incredible speed of execution by the Moderna team in spinning up a vaccine in 42 days is a feat which deservedly made them, a biotech company, into one of the most recognizable companies in the world.

The contraction of biotech enthusiasm was severe as interest in the pandemic waned. During this timeline, the public market enthusiasm for AI in drug discovery also contracted and still stays low relative to the initial IPOs. High profile platforms with unproven clinical value gave new and old investors scar tissue (e.g. Relay, Recursion, Atomwise, Exscientia) and made the broader field cautious.

Ultimately, drug discovery is the deepest of deep techs, akin to space tech, in terms of capital requirement and timescales. However, the difference in making sick people healthy doesn’t quite capture the imagination of society (except in edge cases like pandemics). This means the pools of capital are smaller, and more traditional, with AI in drug discovery companies walking the line of traditional biotech in terms of data packages while selling a story of potential for outsized returns based on many shots on goal. The only problem is, the source of continuous, growth stage capital is much more tied to traditional biotech investors which caps the vision. We believe this is the short-term problem for AI in drug discovery and are still actively looking for investments in this field. As soon as one company shows increased clinical success, there will be another moment of everyone piling on again. Founders building in this space need to keep their heads down acknowledging that this is part of the innovation cycle which they can eventually capitalize upon if their companies stay alive.

Speed

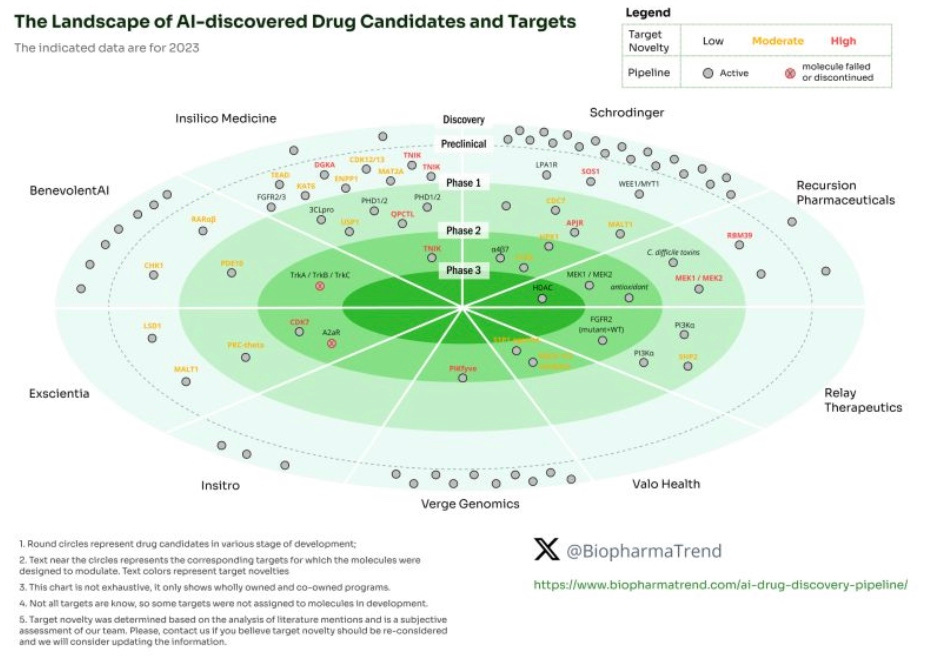

Given the contraction of capital, the burden of proof for validation has shifted significantly for companies building within TechBio. As discussed in our Annual Letter and in Building Bio Platforms in non-ZIRP, this has manifested in platform build tradeoffs for furthering assets. We’ve also seen immense creativity around indication selection around rare diseases which could lead to human proof-of-concept data relatively quickly. This is especially important if the modality or target is invalidated as the incumbent investors are less likely to take target or modality risk. Partially evidenced by this graph showing most AI in drug discovery companies *don’t* take high target risk (except Insilico Medicine).

https://www.linkedin.com/feed/update/urn:li:activity:7186699594376822784/

We believe this is short-sighted in terms of where step-change innovation will come from within human health and biology. In fact, target discovery for pre-clinical R&D and patient stratification for clinical advancement of drugs is one of the only places we think venture scale businesses can be built without developing their own pipeline. This is due to grounding literature where medical records, metabolome, and paired polygenic risk scores and clinical data being used to predict multi-disease outcomes.

Data flywheels

There’s an inverse data problem with drug discovery which is that the most valuable data is the most scarce, most expensive, and can’t significantly contribute to developing better drugs by a startup (given the 3-7 years to get to clinic). This is why speed to clinic in rare diseases is interesting. Barring this, predictive validity becomes key in deciding on how much to weigh results from experimentation and aggregating publicly available disease information like Pheiron* does, thus shortcutting the entrenched data collection process. There’s also been strides in using patient derived tissue (Xilis, Pear Bio*, Oncoprecision), recapitulating human environments with pressure and shear stress (Vitroscope, Emulate Bio).

Linking these models to clinical success could be an incredible step change in treating disease and are excited by founders building in this space. We think there’s really interesting opportunities in the immunology and neurology space.

Summary

The ever-present tension between atoms and bits in biotech means that companies being built here have to thread many needles. The general consensus for startups is that you focus on one thing really well, dominate, and repeat in a broader market. However, this cannot be true for biotech companies, especially those in AI in drug discovery because of the requisite experimental testing (from cells to mice to humans) and AI advancements themselves. Tactically, this means inter-team communication and operational goals have to be clearly communicated across the disparate parts of modern biotech companies in a way that may feel like over-explaining by the founders. What I mean by this is that to founders with a birds-eye view of a business, it’s obvious that the discovery on the experimental side directly feeds into the platform and commercial components but to those on the team, the interlocking and interdependency of progress should be emphasized as well.

The way that AI in bio companies drive the most value on the 10-year time horizon is still to be determined with people working towards more application-focused approaches (platform to cure specific diseases) and those on the foundational layer (towards General Biological Intelligence). For founders, there’s less business model and technical risk by working on the application layer and ability to directly cure disease. On the foundational layer, there’s both technical and business model risk. Technical risk here mostly stems from uncertain scaling laws with biological data - not knowing what size data, parameters, or compute unlock GBI. Business model risk is also a factor because the lead time to reach breakaway events might take longer than expected and require intermediate validation from industry incumbents. We feel particularly well-placed to support founders on this journey as portfolio companies building on the foundation layer in different industries with strong incumbency dynamics. Our portfolio companies from the tech world, RunwayML and Wayve, faced similar dynamics and have been able to navigate this successfully.

Core innovations (such as those in AI architectures) permeate industries on different timescales. Since biology is a smorgasbord of data types, messiness, long experimental feedback cycles it means that the commensurate step change in GBI hasn’t yet happened. Simply put, this is because biology doesn’t have a huge pile of useful data (like the internet) to train on. The upshot for bio companies is that many will build performant application-centric businesses off of fine-tune large models which create excitement. Then you’ll have GBI companies that capitalize and improve upon that potentially by orders of magnitude (raising a lot of money, getting a lot of data) along with technological breakthroughs. With these companies, it will take a longer time to get to an exit. Either way, we continue to be committed that AI in bio companies will create meaningful outcomes. When this happens there will be a resurgence in general public interest in biotech which will surpass COVID levels and productivity gains to (finally) match enthusiasm.

Thanks to Mike for your edits on this piece!

___________________________________________

*Indicates Compound portfolio companies.

Thanks for including our infographic on target novelty and AI-discovered candidates.